Bitcoin or Blockchain?

Let’s have a look at a decade-long discussion in this post. ‘Which one matters? Bitcoin or Blockchain?’

During 2015-16s, there has been a major discussion among various tech circles. A group of people, which are new to the area, and mostly coming from the corporate side, has voiced a new idea called ‘It is Blockchain that matters, not Bitcoin (or cryptocurrencies in that sense)’.

What is the relationship between Bitcoin and Blockchain?

Bitcoin is the first real-world adaptation of Blockchain technology. Actually, if you talk to die-hard Bitcoin people (who are also called ‘Bitcoin maximalists’) they will despise this definition.

According to Bitcoin maximalists, there is no such separate term as ‘Blockchain’ but rather, Blockchain is the underlying technology developed thanks to Bitcoin. This is really a ‘chicken-and-egg’ problem, and quite honestly both sides’ arguments have some merit.

|

|---|

| Image by Alexas_Fotos from Pixabay |

Blockchain, as “the technology where independent machines that are dispersed all around the world, act selfishly yet work in harmony and execute various transactions without the need of a central authority” is a novel idea. It has been brought into life, thanks to Satoshi Nakamoto, the anonymous founder of Bitcoin.

So there would be no Bitcoin without Blockchain. On the other hand, if we did not have Bitcoin as a real-life use case, then I am sure Blockchain will not be that popular either.

Why do we have such a discussion then?

The main cause of such discussions is coming from the philosophies that are dominant on each side of the argument.

Bitcoin has rebellious roots. It comes from the idea that central authorities, be it tech giants such as Facebook or Google, or governments (particularly authoritarian regimes), exert way too much power on individuals. We, individuals have no power to balance this out.

Bitcoin aims to provide power to people through a currency, which they use to preserve their wealth and transfer to each other without the interference of a middleman.

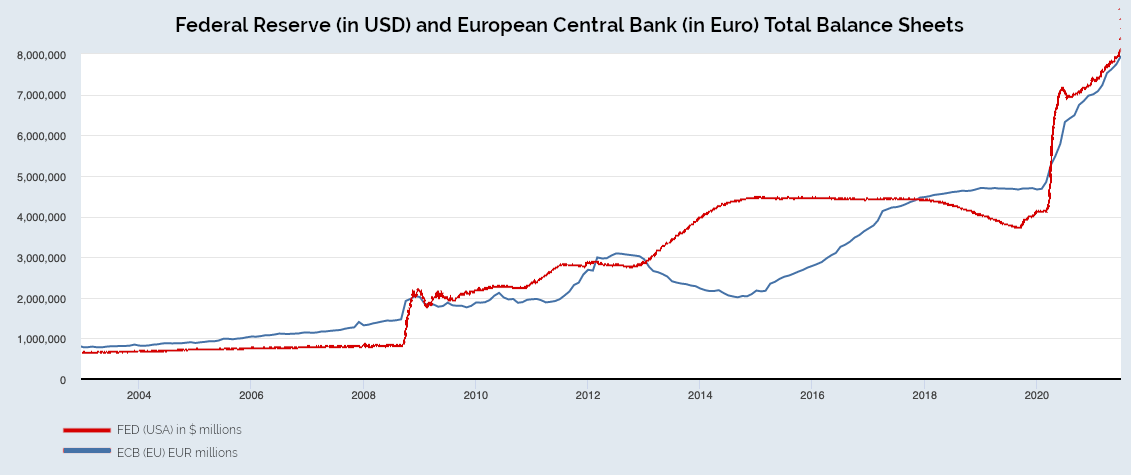

This would reduce the impact of any government monetary policy that results in inflation, which was evident in enormous money printing exercised by US Fed and European Central Bank.

|

|---|

| FED and ECB total balance sheets. Source StLouis FED |

This would also result in people sending wealth to another (say, their loved ones in other countries) without any restrictions. This may seem marginal to those who live in developed world, but do not forget that 1.7 billion people has no access to banking system. Remittances (those working in another country sending money to their families at home) are 700 billion dollars business according to World Bank.

In that sense, Bitcoin gives people power and more importantly hope. Hope that they have more power in their hands and they may look future with more security.

This is the bright side of Bitcoin. There is always ‘the other side of the coin’ and somewhat ‘coincidentally’ you hear the ‘other side’ more often in the media. That is, Bitcoin is used by criminals and for money laundering activities. There are millions of articles for and against this issue and we will not get into that in this discussion.

Many in the corporate world, have seen the potential of the underlying technology behind Bitcoin - that is the ability to eliminate the middleman which may result in cost reduction, and new opportunities. However, the ‘rebellious’ nature of Bitcoin did not appeal to them, and rather than looking for an alternative to Bitcoin they totally separated out the cryptocurrency part from their equation. Hence the notion called ‘private blockchain’ was born.

IBM through Hyperledger was the leader of this initiative. While being a hot topic during 2017-18, the whole ‘private blockchain’ idea lost steam recently. There could be many reasons for that, such as the inability to achieve desired results, inefficiency of blockchain relative to central systems, so on and so forth. Some still insist that ‘private blockchain’ is here and will gain traction again in the long term.

We will see. What we know now, is the fact that the flagship IBM has significantly scaled back its blockchain unit, which was a real blow to proponents of private blockchains.

We will continue with public blockchains in our following posts.

This piece is first published in BlockchainIST Center on August 21st, 2021.

None of the views expressed in this article should be considered as investment advice